Slurp's current listing on Google

A couple of years ago, I carried out a little research among UK independent wine retailers asking them what concerned them most in terms of competition. The most widespread fear at the time seemed to lie in the form of one company: Slurp.com. A pure-online business with ambitions to offer a comprehensive range of wines (it claimed to be the "largest online retailer"), it seemed to offer everything that all those indies would have liked to be able to do themselves.

The Slurp home page

Some of the more ambitious wines on the

Slurp website

Slurp website

It had a smart website

and £15 Italian Pinot Biancos and £16 New Zealand Chardonnays, aspirations to

sell "fine wine" and, best - and most frighteningly - of all, backing

from a company called Aspiration Capital Management. Underlining the

philosophical kinship Slurp had with the indies, Slurp's CEO, Jeremy

Howard was quoted in a Drinks Business piece as saying that

“The consumer online wants a focused experience, not a supermarket

experience... We don’t fear the supermarkets.”

The profile - in June 2012 - suggesting that Slurp was leading

a UK wine retail revolution

a UK wine retail revolution

The video channel

Unquestioning coverage from another UK publication

of the shift into fine wine

of the shift into fine wine

How things change... The Drinks Business coverage

of the acquisition of the "troubled" company

of the acquisition of the "troubled" company

Mr Howard may look back on that comment

ruefully. Today, his UK business has collapsed and been sold by the

administrators, along with what Greg Shaw, commercial manager of the purchaser,

EH Jones, described - in another Drinks Business piece - as

"a small amount of wine for immediate delivery".

Shaw went on to say that "Slurp had been growing its sales and customer base but was unable to trade profitably in the UK... [the company] had worked very hard to build up its business over time and, although it was building up sales, its overheads were running ahead.”

Shaw went on to say that "Slurp had been growing its sales and customer base but was unable to trade profitably in the UK... [the company] had worked very hard to build up its business over time and, although it was building up sales, its overheads were running ahead.”

Without any inside knowledge, my instincts are

that this is yet another story of wine-loving, and dare I say, romantic,

investors imagining that wine retailing in the UK has more to offer financially

than it does. Simon Baile, briefly owner of Oddbins can fairly be accused of

romanticism in the ways he both purchased the chain from Castel its French

owners, and subsequently ran it into the ground with debts of £20m. But almost

none of those accusations were made at the time. Even today, a search on Google

reveals a wealth of unquestioning articles about how Baile was going to rescue

the company.

One of few covering its slide. (Revealingly, these

stories tended to be written by non wine-specialist journalists)

Whether Peter Jones, the Burgundy-loving entrepreneur best known for his appearances on the UK Dragon's Den series, was romantic in backing an online venture called Gondola Wines is not clear.

The man behind yourfavouritewines.com

Today, the business has been rechristened yourfavouritewines.com and is very clearly focused on competing head on with the supermarkets. Brands are very much to the fore (as in supermarkets, or even more so) and the only Burgundies Mr J will find there for his delectation are exclusively Louis Jadots.

yourfavouritewines.com's home page - reminiscent of

a supermarket aisle.

a supermarket aisle.

Angela Mount, the canny former Safeway buyer Jones chose as the website's buyer certainly is a realist - as many suppliers can attest - and the 50%-off discounts and big-brand £5.49 bottles offered on the site are clearly aimed at people who usually do their shopping in supermarkets. Quite how successful yourfavouritewines.com has been is another question, however. Few I imagine would use the term "online wine megastar" that appears on a 2010 news post - the most recent I could find - on Jones's PJ MEDIA website.

2010 coverage - on Peter Jones's corporate website -

dates from 2010

dates from 2010

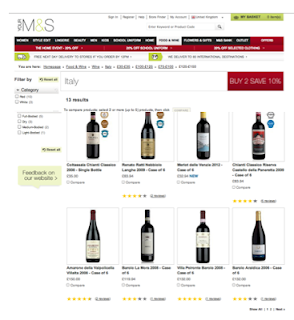

So who should the independents fear? Apart, of course, from each other. First and foremost, there are the people about whom Jeremy Howard of Slurp was so dismissive. UK supermarkets are doing very well thank you with their online businesses. The UK's "largest" online wine retailer was not Slurp, whatever the collapsed firm's Google listing may still say, it's Tesco. M&S have built a strong online business - selling branded wines that are not available in the shops and Waitrose is also a far better place to shop on screen than in the flesh.

Some of Tesco's 2009 Bordeaux...

...and Waitrose's Germans

...and M&S's Italians

And now, Morrisons has joined the fray - with wines like Trimbach Alsace, Laroche Chablis and les Ormes de Pez Bordeaux and an innovative "Taste Test" programme devised by Bibendum.

Morrisons' clever online taste-test

They should also fear the steady growth of Majestic - both on the street and online - and traditional mail-order/online businesses such as Lathwaites, the Wine Society and Naked Wines. Of these, Naked is particularly interesting in the way that it has convinced customers that they are buying more or less directly from small producers. The way that the company funds its smaller suppliers is undeniably original, as is the use of social media, and its highly successful live events.

Naked Wines' website, promoting the way

the direct-selling retailer has helped anindividual winemaker

the direct-selling retailer has helped anindividual winemaker

Much of what Naked Wines does is, however, very comparable to its competitors Laithwaites' and the Wine Society's tastings are well attended too, as of course are Tesco's brilliant;y successful Wine Club events. Botter, supplier of many of its Italian wines is also the name behind similar numbers of that country's reds and whites in, yes, Tesco. The £40 Naked Wines vouchers that fall out of your Amazon parcel are not that different from ones you might have seen from Virgin.

Naked Wines' page on Alessandro Botter reveals thatBotter's is "a big business by Naked standards" - but maybe

not how big

not how big

Finally, however, there is another little threat they might like to consider, in the shape of firms like Vintage Marque. If you haven't heard of this young UK specialist, you might be impressed by some of the producers on its website: Guigal, Torres, Torbreck. Warwick Estate, Bouchard Père et Fils, Barbadillo, not to mention, Cockburn's, Dow's, Graham's and Blandy's.

Vintage Marque, the new retail brand from wholesaler

John E Fells

The clue to Vintage Marque lies in those last three brands - all of which belong to the Symington family which also owns a well-respected wholesaler called John E Fells. In other words, one of Britain's top wholesalers now has a retail arm. Fells doesn't undercut the retailers who sell its wines - in fact its prices are among the highest on wine-searcher.com - but let's face it, when someone buys a Guigal Côte Rôte from Vintage Marque, they're not buying it from an independent retailer.

I'm not saying that a flood of wholesalers are going to follow in Fells' footsteps, but I wouldn't be surprised to see at least a few... And what I am saying is there are some salutary lessons to be learned from the failure of such widely touted recent UK industry players as Simon Baile and Jeremy Howard.

If I were an independent retailer in the UK today, I certainly would be a lot more worried about online retailers with a human dimension like Naked, and about Tesco Fine Wine and the way that it and the other supermarket online offerings evolve, than about the Slurps of this world.

If I were an independent retailer in the UK today, I certainly would be a lot more worried about online retailers with a human dimension like Naked, and about Tesco Fine Wine and the way that it and the other supermarket online offerings evolve, than about the Slurps of this world.

Jonathan Hesford wrote on Facebok What you write is true. The British market is pretty much divided into three sectors. Supermarkets who focus on casual shoppers and fake discounts, big mail order/online clubs who focus on "a little knowledge" and bogus wines and independents who focus on wine enthusiasts and relatively unknown wines. Each player generally fears other players in their own sector, not in other sectors. Although they all try to gain custom from the other sectors.

ReplyDeleteThanks Jonathan. And as I say, bear in mind the way that companies can shape-shift. Tesco could own a chain of wine shops, just as it now owns a chain of garden centres (Dobbies) and family-friendly restaurants (Giraffe).

DeletePeter Richards wrote on Facebook Interesting piece, Robert, thx for posting.

ReplyDeleteThanks Peter

DeleteMark Steven Deamer wrote on Facebook this is like advising people to avoid proper restaurants because the vast majority of the population eat at Macdonalds/KFC/BurgerKing. Bowing to the lowest denominator for market share rather than working hard to drive the market. Lazy!! Putting out a report saying the general public prefer cheap and in volume is like putting out a report that reveals that bears deficate in woodland areas

ReplyDeleteNot precisely Mark. My point is that if you can combine convenience and quality you can score. I have reservations about Nespresso, but the coffee tastes good and reliable and it's as simple as instant. Or nearly. The wine industry revels in being inconvenient. From the need for a corkscrew downwards... And a lot of the inconvenience has nothing to do with the quality of the stuff in the bottle.

DeleteCatherine Monahan wrote on Facebook Disagree with you totally on this one... look at The Sampler Wine Merchant - convenient - right next to South Ken tube station... I don't think he sells very much wine under 10 pounds.... Then you have Sainsburys or Tesco or etc.Local outfit... which is convenient.. BUT the quality for value is whacked right up - due to the convenience.. is that fair? Maybe yes but not for 1-2 pounds extra, no... So... What is convenience... it depends... Mark is right.. it's lazy... yes the market in its masses might want sub 5.99 wine but when you ask them how much they spend, it's always higher and when the higher profile wine consumer buys at The Sampler they don't mind... and when the average person has to overpay at a local grocer for the extra hours it's open - do they mind? Bet you it has occurred to them and annoyed them that they saw that wine cheaper in the main street but they might still buy it... but it's a very different thing to Starbucks in this instance... People are addicted to the Starbucks brand - it stands for something.. they don't care where it is or that a cup of coffee goes up 20c... it's "their Starbucks" - they have a relationship with it... and VERY few people have any kind of relationship with a wine brand...

ReplyDeleteThe Sampler is a VERY different model to Slurp. I love it too, but I'm not sure how scaleable it is - any more than I can imagine opening a chain of Vinoteca wine bar-restaurants. I'd say that the Sampler fits directly into my first point - of indies having to fear other good indies: I wouldn't want to be a less interesting Kensington wine retailer along the road from the Sampler.

DeleteChris Kassel Bears replied on Facebook ??? I thought it was the Pope.

DeleteChris Kassel wrote on Facebook Also a lesson for the caffeine industry, which is why I have patented a smokable form of coffee. Crystalline, fully-legal crack caffeine. All the uplifting energy buzz without having to go wee-wee every ten minutes.

ReplyDeleteSally Marden replied on Facebook The second genuine laugh I've had today. (I live a slow life.)

DeleteFiona Beckett @winematcher wrote on Twitter

ReplyDeleteInteresting. Have just been to a v well attended (400+) @NakedWines tasting in Bristol. They're clearly doing something right

I've seen the same thing - and been similarly impressed by the enthusiasm of the attendees.

DeletePlanet of the Grapes @planetotgrapes wrote on Twitter

ReplyDeletePlanet of the Grapes @planetotgrapes

@winematcher @robertjoseph @NakedWines some of us indys dont fret about our websites, we like to drink with our customers. Much more fun!some of us indys dont fret about our websites, we like to drink with our customers. Much more fun!

Different strokes for different folks. Whatever works for you and your customers...

DeleteMatt Walls @mattwallswine

ReplyDelete@winematcher @robertjoseph wrote on Twitter Great piece Robert. Naked Wines held very differently in the view of its customers vs Slurp though I suspect.

I agree

DeleteRichard W. H. Bray @RWHBray wrote on Twitter

ReplyDelete@robertjoseph @mattwallswine @winematcher The most successful independents in last decade succeeded because they knew not to compete with the supermarkets, but to simply provide the best possible experience (and selection) the idea of the supermarkets actively taking them on on their own ground is scary, but I’m not sure Tesco and the like are willing to scale down enough to do so… Bordeaux 09 easy as a lot of wine produced. But small, limited cuvees? don’t think they can go there… and hope they won’t... Ah, but no margin in wine retail. Bet on market share at expense of profit is what sank Slurp.

Thanks Richard. We'll see. Small limited cuvées may well remain the preserve of indies in the UK - but Costco has showed that it can buy - and sell - those kinds of wines in the US.

DeleteExcellent piece, Robert. Irrespective of one's wine preferences, the wine sector is business. It's just often not run like one.

ReplyDeleteYour point about the romance of wine is underplayed. There are far too many examples of Indies focusing on the fine wine market, and failing. Just to add to your examples, remember a certain Lot (which will remain nameless) of business that tried to import a wine commerce model into the UK... How long did that venture last?

As you've regularly stated, Robert, the UK market is dominated by large retail. This coupled with abundant wine choices by country have made the UK consumer particularly discerning when it comes to seeking a purchase of good value. They now don't need to (and mostly don't want to) learn about whether an unknown Sonoma Valley Chardonnay at 8 quid is better value than a 9 pound Santenay from a different year. Essentially, they trust the retailer enough to believe that the wine will be good enough, so they choose on price.

The wine sector has contributed to the demise of independents by insisting on making every offer as incomparable as possible in the last 35 years. Thus, the average wine consumer is overwhelmed by the prospect of evaluating which offer is better, and then reverts back to what they know. In the end, the evaluation eventually becomes about price.

Independents regularly decry the consumer's lack of interest in evaluating the wine sector's offers, and proudly respond by stating that they'll only cater to the fine wine segment. Sadly, the sums in that segment don't add up. There just isn't the demand. Additionally, the wine consumer in the fine wine segment, paradoxically, expects better value, just at higher average prices. So Indies then have to provide more service and better information, for a small segment of consumers, who will pay more, but expect even more in the consumption experience in return.

The heat generated in the market by the mirage of the fine wine enthusiast has no doubt been stoked by the secondary market in China. But, we seem to forget that the UK is not Hong Kong. Although the bulk of the world's iconic wines are in the far East; as this market moves from a focus on the pursuit of Bordelais icons, through to icons from other French regions, then other countries, I predict a fall in average prices as the consumer becomes reluctant to pay top price for that Grand Cru Burgundy. The fear that the prospective business partner prefers a cult Rioja with a red label will lead to the enthusiast wanting to reduce the risk in the purchase. In the end, this leads to a reduction in the price that the consumer is willing to pay...

I'm sure that we'd all like to only buy wines at our favourite independents. The romanticism of working in an indy wine story is a nice thought, but try to think about the viability of the independent model the next time you hear your wine-lover friend talk about how "I know the owner of that estate, and I can get it a bit cheaper than that ". There's a market for them, but it's just not that big!

Thanks for a great response Damien. It's also interesting to see that Jeremy Howard is now running Slurp Hong Kong.

DeletePerhaps one of Slurp's mistakes was to rely heavily on on-trade suppliers' wines for their catalogue. Wines that are a hand-sell with sommeliers, let alone from a simple web-based interface. That and the fact they were often operating at 10%GP; a fact I often pointed out to my suppliers - not good when an account can buy from Slurp (inc VAT) at a lower price from said supplier's DPD (ex VAT) list.

ReplyDeleteYes, it was a faulty model in more ways than one...

DeleteGreat Western is now retailing Enotria's list with big discounts and a low threshold for free delivery

ReplyDeleteAnd doing so very well...

DeleteRe the last point, I use Enotria as one of my suppliers at wine tastings and like their wine range - my prime business is not selling wine, so being 'undercut' by Great Western is less of an issue for me , but i can imagine that a number of independents that Enotria supply will not be too impressed if Enotria use Great Western as a shopfront for their whole range

ReplyDeleteThe problem, Adrian, is that the UK environment is basically a very difficult one. It's easy to look at the independents as an attractive market, but they're hard to service:

ReplyDeletea) there are around 1000 serious independents few of whom can buy significant volumes of any wine. To sell a bottle a day of any premium wine would be extraordinary - but that would only represent 25 cases.

b) the clue is in the name: these are "independents" who often like to have different wine to their neighbours. So, if you've sold your Ch Pastropchere to Jones Bros of Neasden, Smith & Sons of Neasden may not want to take it

c) Indies have limited ranges. Jones may take the Pastropchere red, but does he have rom on his shelf for the Reserve, the white, the rosé and the late harvest that the chateau has insisted on you taking as his importer

d) Indies are financially far from stable. Late payment and bad debts are a major issue.

Take these factors into account and you understand why a wholesaler is tempted to open his own retail business

Good points Robert, which i agree with and it is plain to see why a wholesaler would see a retail arm as an attractive add on. Bibendum do both, but their retail arm's prices rarely undercut the RRP of their trade customers (summer & winter sales excepted)

ReplyDeleteNot undercutting the trade customer is key - as any sensible winery with cellar door sales knows.

Delete